A certain investment on everyone’s lips around the office. A “sure bet” to make 10x your money. News picking it up everywhere and social media buzzing on how much everyone has made (or is going to!). No, I’m not talking about GameStop going “to Mars”, I am talking about the crypto-currency madness that was the end of ’17 and the beginning of ’18. And despite making some people a lot of money, it left just as many (and perhaps more) losing out on thousands.

Fast forward to 2020 and the COVID crash. The initial numbers were staggering, and with the elderly seemingly far more effected, I started hearing people talking about perhaps the largest transfer of wealth in history. Oil futures hit negative numbers and people piled into Robinhood for more “sure bets” that the market will collapse soon. People were talking nonstop about buying puts on some industries and calls on others, but a month or so after, it all was quiet as the market largely resumed what it was doing in regards to many industries. Those that screamed loudest about the next “sure thing” nonstop just a day ago would suddenly not engage me in conversations about investing at all. Just like the time period above, some active investors made money and many did not.

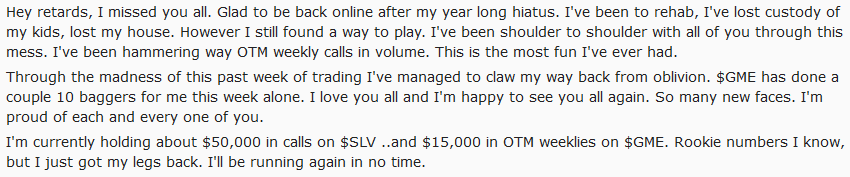

So, 2021 is upon us and we are off to yet another “sure bet” as history keeps repeating itself, this time with GameStop, BlackBerry, AMC, and a few others. Another “sure thing” and “we’re all going to be rich!” mixed in with some “screw Wall Street!” sentiment and pictures of people making money, quickly followed by outrage and frustration of certain trading apps refusing trades and seeing plenty of pictures and stories of people buying at $450+ the other day and panic selling around $300 as it closed the week at ~$310 after hours. I actually just finished reading this post from someone who lost $7 MILLION, his family, house, everything… went to rehab and is now back to playing with options:

All of this, to me, is a fascinating look on the psychology of money and a time where I just have to put in my two cents. It’s not new that people largely want instant gratification over the long term slog. It’s witnessed in diets, finances, substance use and abuse, social media (ping! here comes the dopamine), and many other facets of our lives. On top of instant gratification is the term that is getting more and more familiar – FOMO (Fear Of Missing Out). None of this has really been new in the world, but there is a particular statistic that pops up with FOMO. The people affected by FOMO most are by far millennials, who experience and let it dictate their life in some way at a staggering ~70% from the various surveys that have been done in the last decade!

So what does any of this have to do with the military?

The military force is overwhelmingly filled with millennials, especially at the “first line supervisor” levels who are in a position to be extremely influential to their troops. Keep in mind that many times these troops are seeing absolute independence for the first time in their lives and a paycheck that is 100% disposable income as the food/housing requirements are covered by the government. So all in all, you have the perfect storm of young adults that are more impulsive and are usually under-educated in finances, immediate leadership that is still just as impulsive AND has a proven response to FOMO (and is likely under-educated in finances as well), money to burn, and the desire for instant gratification.

It has been a little sad watching people throw money into this “cause” with no research at all. To me though, it is even MORE upsetting that these same people often talk up how they doubled their entirety of savings (typically somewhere around a $1K investment) and now they can do X, Y, Z that they could not do before. I even heard someone go on a 10 minute+ rant about the situation where Robinhood restricted trades and how he lost out on a “free $60” that you would think from how he went on, was a life or death situation for him. All this brings me to my final point…

I truly hope that nobody in the military in normal circumstances is out there in a position where $1-5K makes such a staggering difference in their lives, especially after they have been in a while. The military essentially gives us the NBA equivalent of a 3-1 lead when it comes to finances where outside of specific and awful situations, we got this in the bag! We don’t have to pay for any healthcare related expenses, get housing either provided or paid for, and have either a free food option on base, or money given to us specifically for food expenses. Our actual base pay is 100% discretionary and in nearly every locale beats the median income (after accounting for housing/food allowances, but NOT counting the free healthcare or tax free statuses of those “allowances”) as a 5-6 year E-5 – which is not a tough thing to achieve.

If you are going to be throwing money into something high risk like crypto, GME, and whatever else is inherently risky and speculative, make sure it is money you are 100% comfortable losing and teach those you supervise to be similarly conservative. Looking at this whole fiasco, I was actually tempted to join in after last weekend (when GME closed at approx $60), but seeing it jump to over $100 pre-market discouraged me from doing so. Even had I gone in with $1-2K of play money, I likely would have sold it after seeing 25%+ gains over a day. Had I held for any reason and had the luck to sell it off at the peak (of nearly 500) I would have turned my $2K into $10K – minus taxes. So what does this actually do for me long term? Well, personally, I’m somewhere between 10-14 years from my retirement and at a 7% increase, it would have turned to somewhere between $20-25K… nearly meaningless in the grand scheme of things. So please, do not miss the forest that is TSP/IRA maxing goals for the trees of a couple thousand dollars overnight.